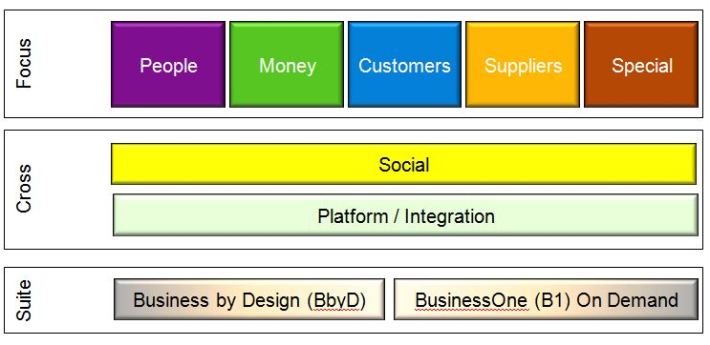

SAP is laying out a strong SaaS program and has keen view of the future. They’ve organized themselves into upper domain areas of: People, Money, Customers, Suppliers, and Special. They then have their horizontal glue layers of Social and Integration. Finally, they have supporting layer of SaaS ERP in 2 flavors: Business-By-Design and Business One. This clearly laid out in the illustration below.

Most of the SaaS attention has gone to People with SAP’s acquisition of SuccessFactors. Indeed, success factors is leading the SaaS charge at SAP both in terms of ideation and management with Lars Dalgaard heading the cloud unit. SuccessFactors brings a SaaS pedigree to SAP.

All “legacy” or pre-SaaS software vendors including those like IBM, Oracle, Computer Associates, etc. all face the same challenge. How to use a usage base metric to drive revenue and determine re-investment. In addition, legacy vendors often haven’t built in cloud capabilities and multi-tenancy which is the key scaling and upgrades leading to lower costs. I think you’ll see legacy software vendors buy some of the skills. I also think as the whole market shifts to cloud, SaaS will simply become the pervasive model and vendors will adapt.

Tersely put, how do you change your revenue stream?

- Old Revenue Formula = Licenses + Support

- New Revenue Formula = Utilization metric (i.e. per user, per month, per incident, etc.)

Honestly, I think the non-cloud and even non-SaaS type application will become the exception. So like all creatures faced with drastic environmental changes, software vendors have 3 choices:

- Move (find business that can’t use cloud or won’t adopt as fast)

- Die (easy, just don’t change)

- Adapt (move to more efficient modes such as re-architecting for SaaS)

One of SAP’s other big SaaS applications is Ariba. In addition to being a substantial procurement software product with huge numbers of consumers and suppliers in their network, they are the model of moving to cloud and SaaS to survive. They have already made the adaption. If SAP is smart, they will take the lessons learned from the trial by fire of Ariba and apply it to their own journey.

I think the movement to cloud, and mostly to SaaS, is one that all vendors will need to follow to remain viable. Keep in mind there are companies today that will join the Fortune 500 in the next 5 years and will have never purchased an enterprise class server or purchased enterprise software. As an industry, How are we going to provide value add services? How are we going to morph our products to meet their non-procurement cycles? Are we going to be part of the company that: 1) Moves, 2) Dies, or 3) Adapts.

Next blog, I’ll talk more about the lower layers of Social, Integration, the two ERP SaaS options which will yield a new way to do roll-outs via 2-tier ERP.